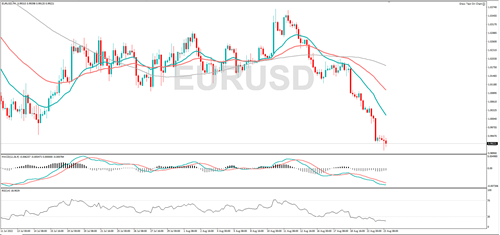

EUR/USD fell to a fresh 20-year low, and momentum is in negative territory, suggesting the bears are dominating. If it falls further, it might target 0.9900 or 0.9800. RSI is in oversold territory so that could be a warning a change in trend is in the offing. A rebound could see it hit 0.9949 or 1.0000.

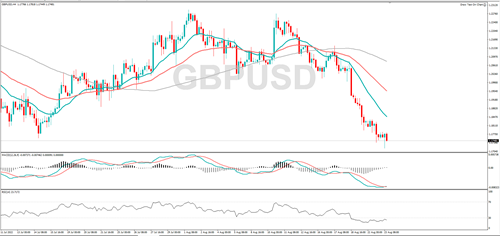

GBP/USD traded at a 17-month low and if the bearish trend continues, it might target 1.1638 or 1.1600? RSI is in oversold territory so we might see a rebound, a rally from here could run into resistance at 1.1825 or 1.1856.

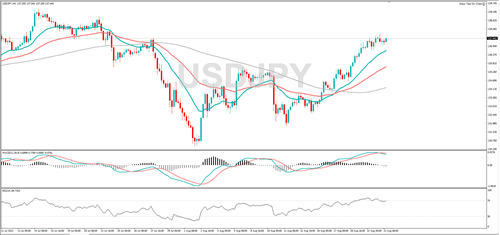

USD/JPY jumped to one-month high. If the uptrend continues, 138.86 or 139.39 might act as resistance. RSI is overbought, and that could be a sign a pullback is on the horizon. A fall from here could see it find support at 136.69 or 135.63.

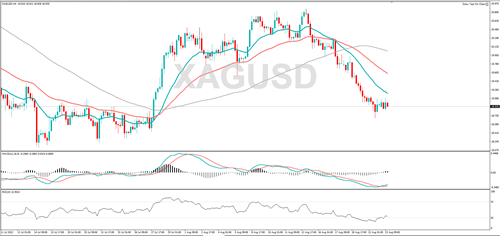

Silver has recovered from yesterday’s three week low, and momentum has turned positive, which suggests the bulls are back in control. 19.17 or 19.31 might act as resistance. If the broad bearish trend continues, support might be found at 18.71 or 18.64.

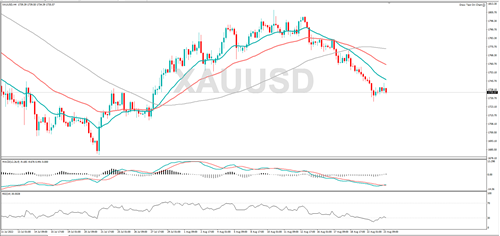

Gold has rebounded, RSI has moved out of oversold territory and momentum is now positive. If the rally continues, it might hit 1749 or 1758. A fall from here could see it retest 1727, or target 1719.

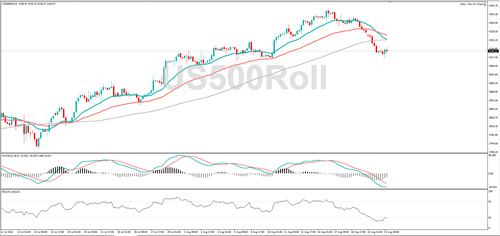

Yesterday, the S&P 500 fell to its lowest level in 12-days, but it is a little higher today. Negative momentum is in decline, suggesting the bears are not as influential as they once were. Resistance might be encountered at 4162 or 4167. If the wider bearish trend continues, it might retest 4122 or 4115.

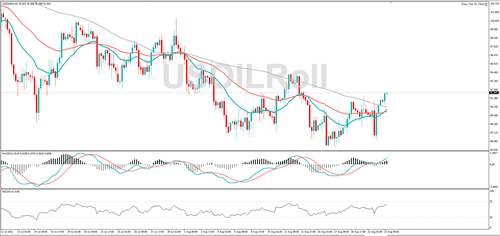

WTI rallied to a one-week high, and positive momentum is gaining ground, indicating the bulls are in control. It might target 92.81 or 94.11. Should the wider bearish trend continue, it might find support at 90.50 or 90.00.