The UK inflation data came in with a surprise for the month of August, rising by more than expected, fueling the estimates for a possible action by the Bank before the end of this year.

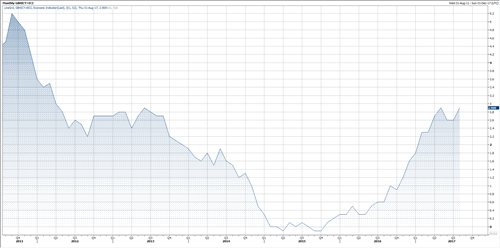

YoY CPI Matches The Highest Level Since 2012

The YoY CPI advanced toward 2.9% in August up from 2.6% in July, while the estimates were to rise slightly to 2.8%. This is the first increase in two months, the second highest reading of this year, which also matches the highest inflation rate since April of 2012.

The MoM also posted the biggest MoM increase since February of this year, which is the second biggest increase so far, rising by 0.6%, while it had been anticipated to rise by 0.5%.

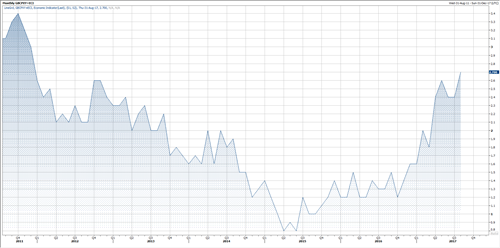

YoY Core CPI Soared To 2.7%

The YoY Core CPI spiked to 2.7% in August compared to 2.4% in July, despite the fact that the estimates were to rise towards 2.5% only. This is the highest reading of this year, and the highest reading since December of 2012.

The MoM Core CPI also came in higher than expected, rising by the same rate of the MoM CPI by 0.6%, which is also the biggest increase since February of this year.

What Does This Mean For The Bank of England

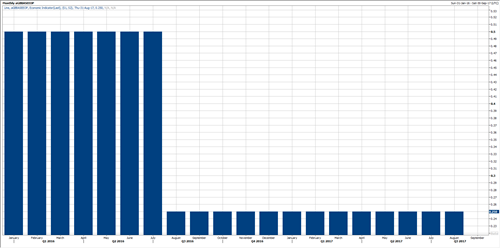

Today’s inflation data fueled the estimates for a possible action by the Bank of England, not in the coming meeting this week, but at least during the last quarter of this year.

Does this mean that the Bank of England will raise the official bank rate anytime soon? It’s a possibility, and this might actually happen before the end of this year, probably in December, if inflation keeps on rising.

Yet, traders need to keep an eye on the upcoming meeting later this week. The interest rate votes matters the most. In the previous meeting, two of the members voted in favor to raise the rate by 25 bps.

In this meeting, there is a possibility for another member to join those two members, which would make them three votes to raise the official rate compared to 6 members to keep the current policy on hold.

If this happens, traders and investors are likely to price in a rate hike decision in advance, starting from this week until at least the next meeting.

GBPUSD In Breakout Mode

The British Pound soared across the board right after the economic releases today, rising by more than 0.8% so far against the US Dollar.

Looking at the technical chart, GBPUSD has broken above its last week’s highs and last week’s resistance area, which stands at 1.3225, and continued to rise toward 1.3280’s, which is the highest level since September of last year.

In the meantime, today’s daily close matters the most. A daily close above 1.3225 would clear the way for further gains ahead.

Any downside retracement might also be limited above the same level (1.3225) as it witches to support. On the upside view, the next first immediate resistance stands at 1.33, while there is no significant resistance after that level until 1.3370 which could be the next stop.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst