During the European session today, the UK inflation data came in with mixed outcomes. However, the Bank of England remains in a dilemma, while GBP remains green on the day until this report is released.

UK Inflation Above BoE Target

Today’s inflation data were mixed, some were less than expected, while some of the figures came in inline with the markets estimates. However, the overall inflation remains well above the Bank of England 2% target, which keeps the possibility for a rate hike in November meeting, despite the fact that growth is still on the downside.

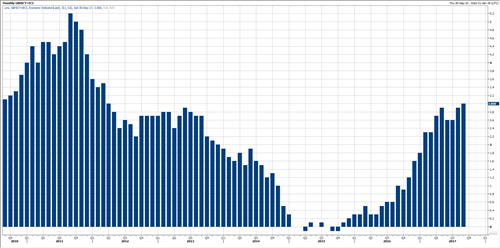

The YoY CPI ticked higher, posting a new high of the year at 3%, which is the second monthly increase in a row and the highest inflation reading since March of 2012. The MoM CPI came in as expected rising by 0.3%

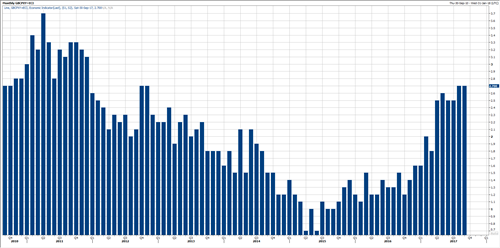

The YoY Core CPI remained stable at 2.7% in September as widely expected. However, this is still the highest reading of this year, and the highest reading since late 2012 as well. However, the MoM Core CPI came in slightly less than expected, rising by 0.2%, while the estimates were to rise by 0.3%.

What’s Bank of England Dilemma?

The Bank of England decided to increase its asset purchases facility right after the shocking Brexit vote, as policy makers thought it would be a clever decision to act as soon as possible.

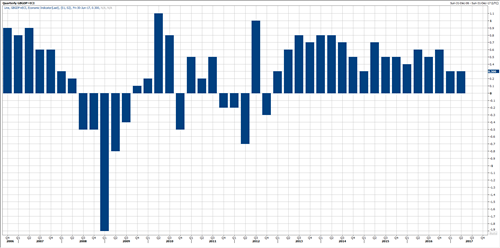

However, inflation soared from 0% to 3% since the Brexit vote. This year, it managed to rise from 1.0% to 3%. At the same time, the growth rates remains at the lowest level since 2015 and matches the weakest growth rate since 2012.

The Bank of England’s dilemma is how to deal with the current situation. Raising rate will curb inflation, but growth is very weak. Moreover, raising rates is likely to put another downward pressure on growth.

Yet, the Bank of England would choose to let the economy to slide in to a recession rather than losing control on inflation, which means that a rate hike is highly possible over the next few weeks.

GBP Outlook

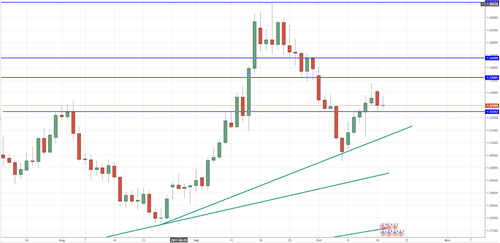

Over the past few days, the British Pound posted the longest daily gaining stake this year, one we have not seen since the end of last year.

Yesterday, GBPUSD declined for the first time after five days of consecutive gains. However, the pair is still trading above 1.3225 solid support area, which held as a former resistance since August.

In the meantime, yesterday’s decline can be considered as a short term retracement. With higher possibility of a rate hike in November, after today’s inflation data, GBP bids are likely to remain on the rise.

From a technical point of view, even if GBP breaks through 1.3225 support area, the general outlook remains bullish as long as it stays above its daily trend lines which stands between 1.3120 and 1.30 on the daily chart.

On the upside view, the first immediate resistance stands at 1.33 followed by 1.3360’s, while a break above those levels would clear the way for further gains, possibly toward 1.3430’s.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst