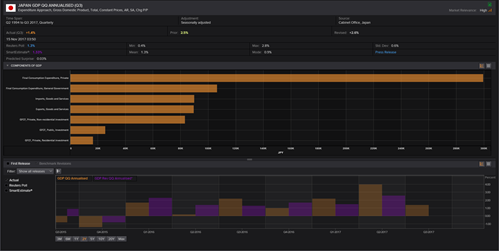

Japan's economy grew for the longest period in nearly 18 years during the third quarter of 2017, with GDP growing by 1.4% YoY and by 0.3% on a quarterly basis.

This indicates the strength of macroeconomic factors in Japan. As employment numbers inch closer to full levels, we should be seeing a boost in consumer spending, which has seen weakness this quarter.

With Japanese Prime Minister Shinzo Abe attaining the majority of parliament that he sought, the government is likely to take new economic measures by the end of this year to boost investment and productivity.

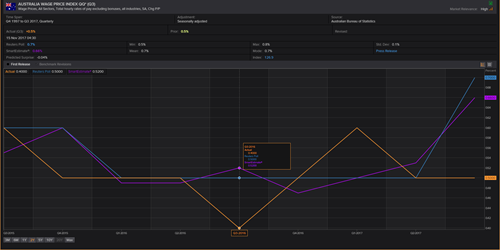

Although Australia's wage growth in the third quarter was below expectations, the Reserve Bank of Australia is still expecting a gradual increase in wages to boost consumption, economic growth and inflation over the coming years.

Wages, excluding bonuses, rose by 0.5% versus expectations of a 0.7% gain, prompting the Australian dollar to decline after the data hitting its lowest level since July 7 at 0.7575.

Given the uncertainty surrounding Brexit negotiations, where the rounds of negotiations are proceeding without any tangible progress, British employment data registered a marked positive growth during the third quarter, but still showed the impact of Brexit.

During the third quarter, the number of people working in Britain has fallen by the most in two years, while the number of people who were neither working nor looking for work has risen to its highest level in nearly eight years. Unemployment stood at a 43-year low of 4.3%. On the other hand, wages rose by 2.2% in the third quarter, and the previous reading was revised up to 2.3%.

Markets are looking ahead to US inflation data to see how they impact the Fed's decision, with the markets pricing in a rate hike for the third time this year at next month's meeting. CPI is expected to rise by 2% in October, and core CPI which excludes fuel and food prices is expected to be 1.7%.