Purchasing managers index numbers for the EU, Germany and France were released today. All figures came in better than expected to give further support to the euro and continue its rise for the third day in a row after the crisis of failed German coalition talks earlier this week.

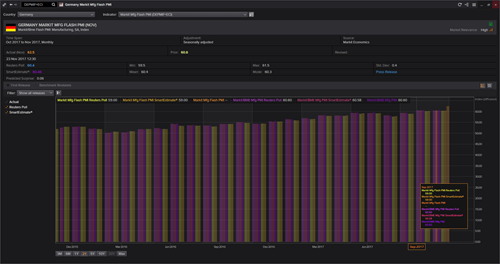

German manufacturing PMI rose to 62.5 in November, the highest reading in 81 months, and the Service PMI rose to 54.9 in November, its highest level in two months.

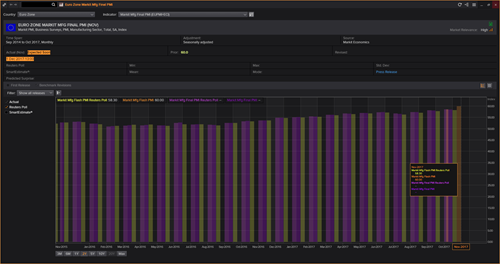

Similarly, the euro zone manufacturing PMI rose to 60.8 in November, the highest in 81 months. Also, the Services PMI rose to 60 in November, the highest reading in 211 months.

These data indicate that there is clear evidence of a recovery in economic growth in the euro area, which would support the ECB's move to soften the quantitative easing program and it now only needs a sign of sustainability in the growth of inflation to begin thinking about ending its stimulus program.

On the other hand, US markets are closed today due to the Thanksgiving holiday. The USD has suffered over the past few days, especially when the minutes of the FOMC were released yesterday night, which showed some members' concern about continuing tightening monetary policy as inflation figures continue to weaken, which would affect on the path of raising interest rates next year, adding to the pressure on the dollar as markets wait for the Senate vote on the tax adjustment bill after the Thanksgiving holiday and the dollar is expected to continue to fall in light of the closure of US markets.

The sterling pound benefited yesterday from the weakness of the US dollar as well as the disappointing but somewhat good budget. The government lowered its economic growth forecast for 2018 to 1.4% from 1.6% and in 2019 to 1.3% from 1.7%.

Oil has eased at the beginning of trading today and is still trading below $58 a barrel, its highest level since June 2015, supported by the collapse of one of the major oil pipelines and the decline of US crude oil inventories last week. Oil producers will meet next Thursday in Vienna to discuss a possible extension of the cut production agreement beyond March 2018.