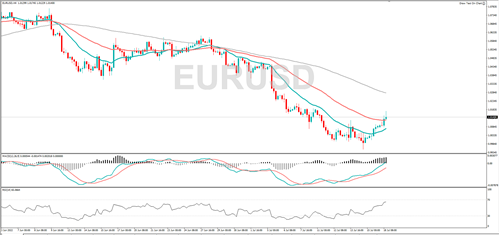

EUR/USD

EUR/USD has rebounded from last week’s 20-year low. The MACD indicator shows us that momentum is in positive territory, suggesting the bulls are in control. A rally from here could see it target 1.0220 or 1.0280. A decline might see it find support at 1.0000 or 0.9951.

GBP/USD

GBP/USD is rallying, and the RSI is moving higher, suggesting the price bias is to the upside. If the bullish move continues, it might target 1.2034 or 1.2164. Should the broader bearish move resume, it might hit 1.1812 or 1.1759.

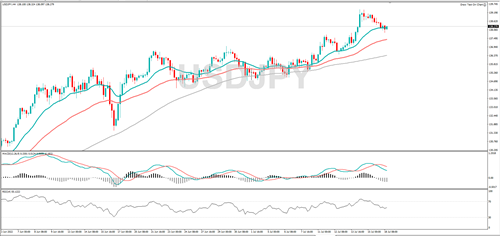

USD/JPY

USD/JPY has retreated from the 24-year high posted past week. A move lower from here could see it fall to 137.43 or 136.38. If the longer-term uptrend continues, it might encounter resistance at 140.00 or 141.00.

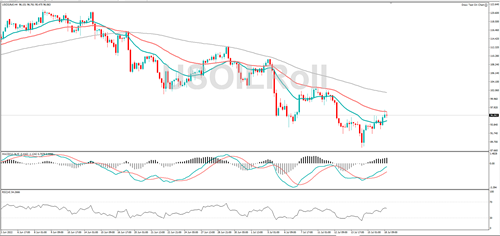

Gold

Last Thursday, gold tumbled to its lowest mark it almost one year. Should the broad sell-off continue, 1697 or 1678 could act as support. A rebound might bring 1745 or 1752 into play.

Silver

Silver is in a downtrend and last week it fell to its lowest level in over two years. If the bearish move continues, it might hit 18.44 or 18.13. A rebound might see it target 19.36 or 20.20.

WTI

WTI printed a five-month low last week, and while it holds below the 100.00 mark, the downtrend could continue. 92.73 or 91.50 could act as support. A break above 100.00 could see it target 101.63 or 102.00.

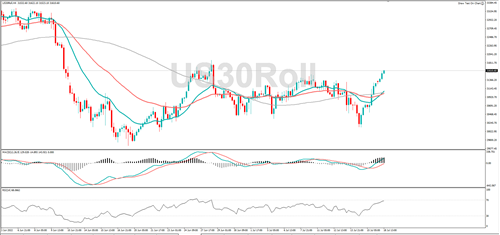

Dow Jones

The Dow Jones hit its highest mark in over two weeks, and there is a steady increase in positive momentum, indicating the bulls are in control. Resistance might be found at 31883 or 32347. The RSI is close to overbought territory so a pullback might be in the offing. Support might be found at 31043 or 30684.