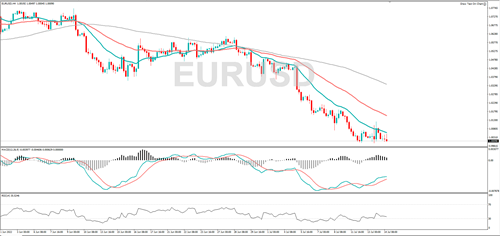

EUR/USD

EUR/USD fell to a new 20-year low yesterday, which highlights the strong bearish trend. If the downtrend continues, it might find support at 0.9900 or 0.9800. The RSI has moved out of negative territory, so that could suggest a rebound is in the offing. Resistance might be encountered at 1.0190 or 1.0220.

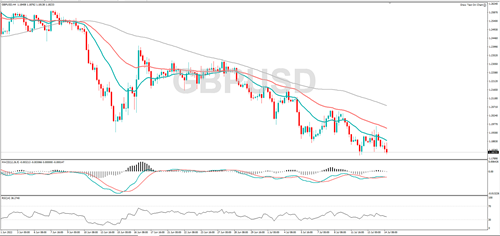

GBP/USD

GBP/USD dropped to a 27-month low this week. Should the bearish move continue it could target 1.1630 or 1.1408. A rally might encounter resistance at 1.2055 and break above that level could see it target 1.2078.

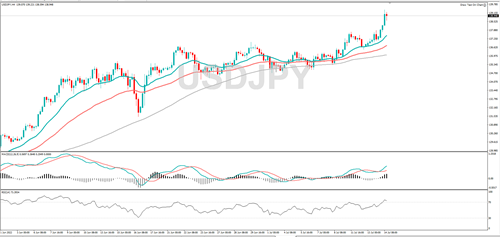

USD/JPY

USD/JPY is in an uptrend, today it hit a new 24-year high. If the bullish run continues, it could hit 141.00 or 142.00. A move lower from here could see it fall to 137.11 or 136.46.

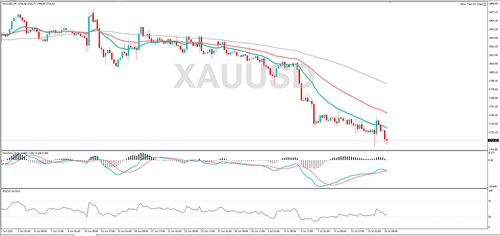

Gold

Yesterday gold tumbled to its lowest mark since July 2021. Should the broad sell-off continue, 1700 or 1677 could act as support. A rebound might bring 1745 or 1752 into play.

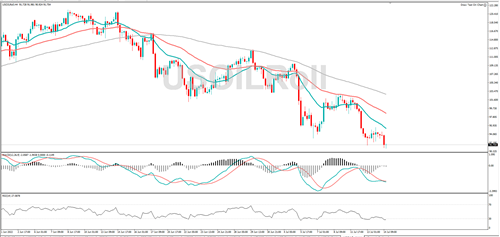

Silver

Silver is in a downtrend and this morning it dropped to its lowest level in over two years. If the bearish move continues, it might hit 17.93 or 16.94. A rebound might see it target 19.36 or 20.20.

WTI

WTI fell to a level last seen in February and if the bearish mood continues, it might encounter support at 87.26 or 81.68. A rally above 95.57 could pave the way for it to test 99.08.

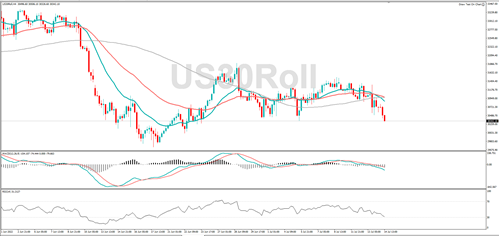

Dow Jones

The Dow Jones is trading in a range and currently it is edging towards the lower end of the range. While it holds below 31350, the bearish move could continue, and it might target 30015 or 29647. A break above 31350 might bring 31510 into play.