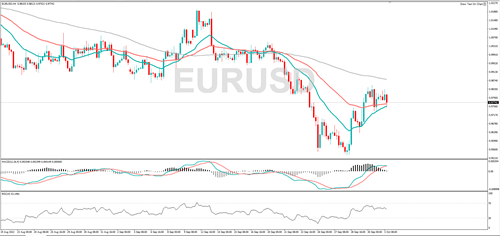

EUR/USD is trending higher, RSI is rising and that speaks to bullish sentiment. Resistance might be incurred at 0.9853 or 0.9906. Positive momentum is falling, so that suggests the bulls are losing influence. If the longer-term bearish trend continues, it might target 0.9684 or 0.9635.

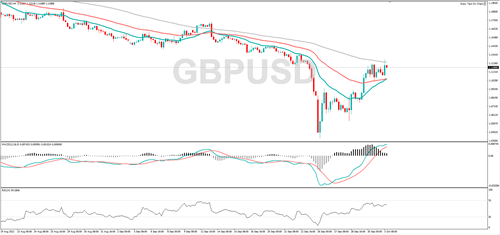

GBP/USD has rebounded from the record low seen last week. RSI is rising, and this implies upbeat sentiment. Positive momentum is fading, so that suggests the bulls are losing influence. If the short-term rally continues, it could target 1.1363 or 1.1459.

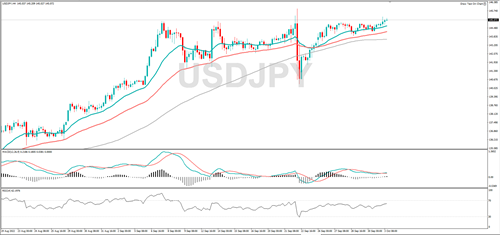

USD/JPY is rallying once again, the RSI is moving higher, and momentum is positive. That suggests that sentiment is bullish. If the currency pair continues to rise, 145.89 or 147.00 might act as resistance. A fall from here could find support at 144.49 or 144.19.

The Dow Jones fell to a two-year, and if the wider bearish move continues it could target 28600 or 28400. The RSI has fallen into oversold territory and that could be a sign a rebound is in the offing. A snapback might target 29000 or 29357.

WTI is trending higher, and the RSI is at the upper end of the range, implying the bias is to the upside. If the uptrend move continues, it might target 82.49 or 83.00. Should the longer-term bearish move resume, it might find support at 80.93 or 79.91.

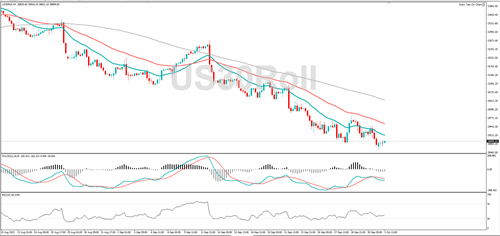

Gold is trending higher, and RSI is rising, and that speaks to bullish sentiment. Resistance might be found at 1675 or 1700. Positive momentum is falling, so that suggests the bulls are losing influence. If the longer-term bearish trend continues, it might target 1657 or 1644.

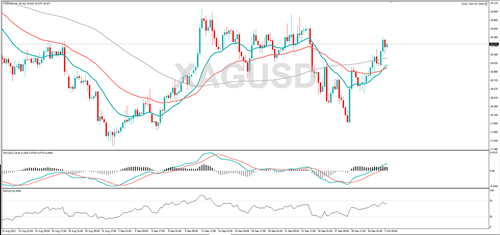

Silver is rallying, the RSI is moving higher, and momentum is in positive territory, both speak to bullish sentiment. If the rallies continues, it could target 19.69 or 19.84. Should silver fall from here, it could target 19.14 or 18.99.