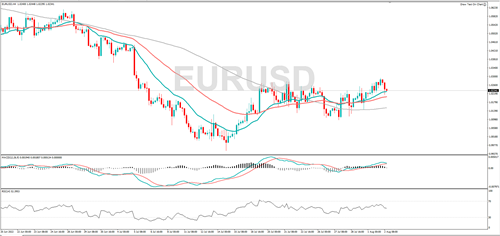

EUR/USD is edging lower and the MACD indicator shows that positive momentum is falling, implying the buyers are losing control. A rally from here could see it target 1.0324 or 1.0400. A decline might see it find support at 1.0145 or 1.0095.

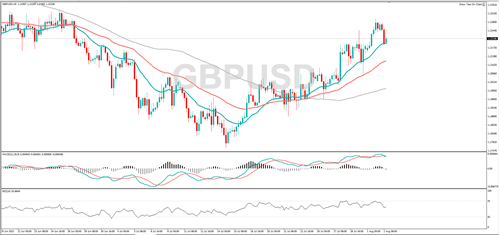

GBP/USD has pulled back from its five-week high, and RSI is moving lower, suggesting the price bias is to the downside. If the bullish move continues, it might hit 1.2331 or 1.2405. Should the currency pair fall, support could come into play at 1.2062 or 1.2019.

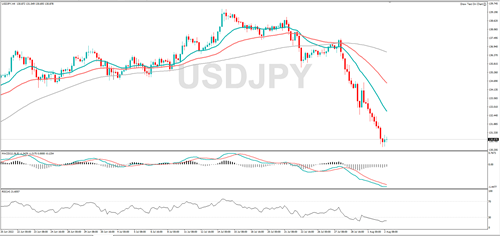

USD/JPY has fallen to an eight-week low, and momentum is negative, implying the bears are in control. A further decline might find support at 129.50 or 129.00. RSI is oversold, so a rebound could be in the offing, a rally might see it hit 132.72 or 133.51.

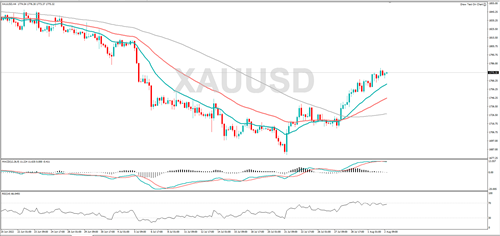

Gold is trending higher, momentum has turned negative, indicating the bears are in control. If the rally continues, it might target 1786 or 1800. A pullback could retest 1750 or 1736.

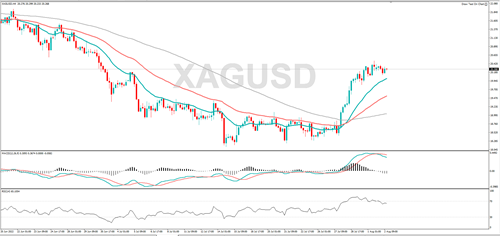

Silver is in an uptrend and if the bullish move continues, it might hit 21.04 or 21.52. Momentum is negative, implying the sellers are in control and a fall could target 19.56 or 19.27.

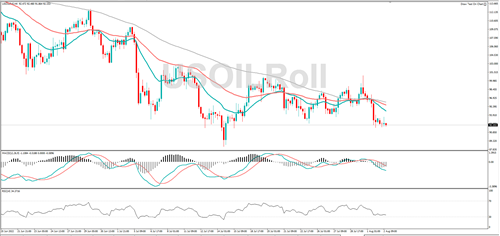

WTI is in a downtrend and the MACD indicator shows that momentum is negative, suggesting the bears dominating. 90.00 or 88.31 could act as support. Resistance might be found at 97.54 or 98.13.

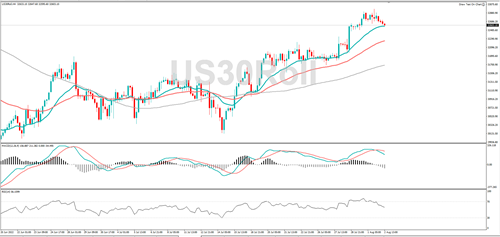

Yesterday, the Dow Jones hit its highest mark since early June, if the rally continues, resistance might be found at 33000 or 33322. Momentum has turned negative, and the RSI is moving lower, this points to selling pressure. 32494 or 32000 might provide support.