Global markets were calm and cheering for the past few days, with the US equities and some of the European equities were at record high. However, this has changed since the beginning of the European session opening bell.

Breaking News

Few minutes ago, a bunch of breaking news headlines came in on the wires, which sparked a notable selloff in global equities while safe haven assets spiked across the board.

First of all, Catalan Leader said that the parliament could vote for a formal declaration of independence if no talks are ahead, he did not clarify whether he has made a declaration of independence of not.

Right after, the Spanish government announced that the spokesman will make an official statement at 10:30 CET on Catalonia.

In addition, Spain announced that the government will trigger the suspension of Catalan autonomy on Saturday.

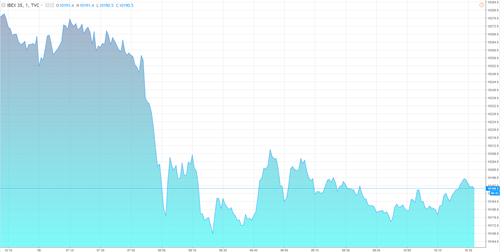

Equities Sell Off

The European equities opened the day sharply lower, while IBEX35 is the biggest looser so far with more than 1% of declines.

On the other hand, the US Equities Futures reacted to this news, DowJones Futures is now lower by -0.3%, S&P500 lost more than 0.55% so far, while Nasdaq is now the biggest loser with -0.6%.

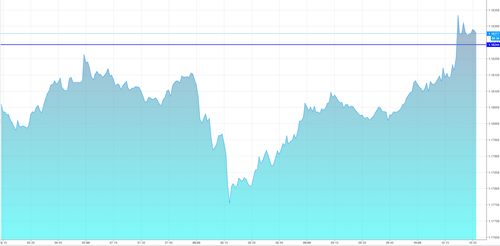

Euro Dump and Pump

The European single currency also reacted to the news, but it was very limited, the Euro declined all the way down to 1.1775 before recovering above 1.18 once again, reaching as high as 1.1810 until this report is released.

For the time being, volatility is here to stay with a possibility for another selloff over the next few hours, but it seems that 1.1775 has some bids.

Safe Haven Assets Turned Green

Since the beginning of the week, safe haven assets has been declining gradually, including Gold, Silver, JPY and Swiss Franc.

Today, things has changed after the news from Spain. The next few hours is crucial for these assets, as further tensions would keep investors away from stocks, and likely to turn toward safe haven assets.

Gold remains supported by 1280, while Silver is trying to hold above $17 since the beginning of the week. At the same time, USDJPY has lost most of yesterday’s gains, declining all the way back to 112.60.

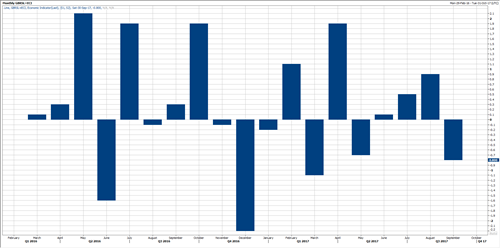

UK Retail Sales Falls In September

The UK Retail Sales showed another disappointment in September, declining by -0.8%, despite the fact that the estimates were to decline by -0.1% only. This is the first monthly decline in three months and the biggest MoM decline since March of this year, which is the second largest decline on this year as well.

As a result, GBPUSD lost 1.32 support area, and continued to decline to as low as 1.3140 until this report is released. However, the pair remains above its secondary trend line support as shown on the chart, which should be watched carefully over the next few hours, as a breakthrough that support would clear the way for further declines, probably toward 1.30 later next week.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst