After yesterday’s inflation data which came in with mixed outcomes, but posted the highest inflation rate since 2012, the UK Jobs Report came in with positive outcomes. However, GBP remain lower across the board.

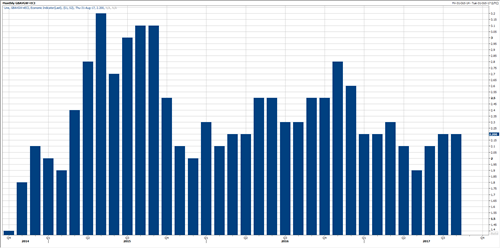

Stable Wages With Revision

The Average Earnings Index YoY came in better than expected, stabilizing at 2.2% in August after revising July’s data higher from 2.1% to 2.2%. Yet, this is still the highest reading since March of this year.

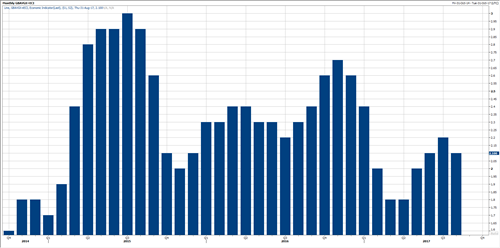

On the other hand, the Core Average Earnings Index came in slightly lower, declining back to 2.1% in August after revising July’s data higher to 2.2% instead of 2.1%. Yet, this is also the highest reaching since February of this year.

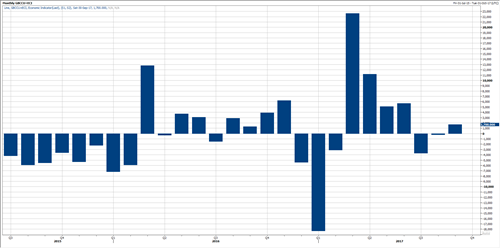

Higher Claimant Count Change

On another note, the Claimant Count Change came in higher than expected, posting the first increase in two months, rising by 1.7K in September, compared to a decline of -0.2K in August, while the estimates were to rise by 1.3K. This is also the biggest monthly increase since June of this year.

Finally, the Unemployment Rate remained at the lowest level since 1970’s at 4.3%

Why GBP Is Declining?

Despite the fact that inflation spiked to the highest level since 2012, reaching 3%, which is 1% higher than the Bank of England 2% target, and despite the recent rise in the average wages, the British Pound continued to slide further.

One of the main reasons the current decline comes on the back of the Bank of England governor Mark Carney, who said that a rate hike might be appropriate in few months, while markets have been pricing in a 25bps rate hike in November meeting. Yet, Reuters is still showing a probability of 78% chance for a rate hike in November.

Moreover, the US Dollar Index is still positive on most time frames as a short term retracement, the index tested its trend line support which stands between 92.80 and 92.60 before spiking all the way back to 93.70’s earlier this morning.

The next immediate resistance stands around 93.80’s which should be watched carefully, as a break above that resistance would clear the way for another rally, probably to retest 94.15 resistance area as shown on the chart.

GBPUSD Nearing Support

The British Pound posed the 2nd daily decline in a row, with today’s decline, this marks the third day in a row. One we have not seen since August.

Yet, the pair is trading near its secondary trend line support which stands at 1.3130, which should be watched carefully, as a breakthrough that support would clear the way for further declines, probably toward the next trend line support which stands at 1.30.

If so, a head and shoulder pattern will be in play, which would possibly target a deeper levels, well below 1.30, with a possibility to retest 1.28 areas.

Otherwise, a stabilization above its trend line support is needed to keep the bullish outlook unchanged.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst