Currencies has been trading within the same range since the beginning of this week, except some commodities currencies including the Aussie and the Kiwi, due to some fundamentals.

However, such sideway trend is likely to continue until the end of this week, as we will be waiting for many economic releases and events later next week, whether from Asia, Europe and the US, which likely to have a notable impact on the markets.

Canada’s Inflation Ahead

During the US session ahead, we will be watching some key economic releases from Canada, which set to have a notable impact on CAD pairs.

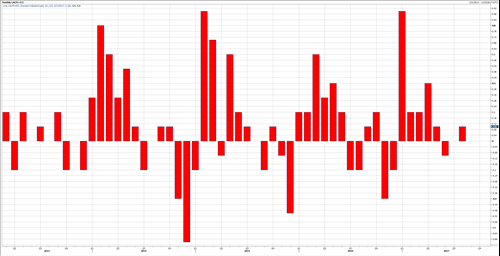

The MoM CPI is expected to rise by 0.3%, which would be the second monthly increase in a row and the biggest monthly increase since April of this year.

The MoM Core CPI is also expected to rise by the same rate of 0.3%, which would be the third monthly increase in a row, one we have not seen since 2014.

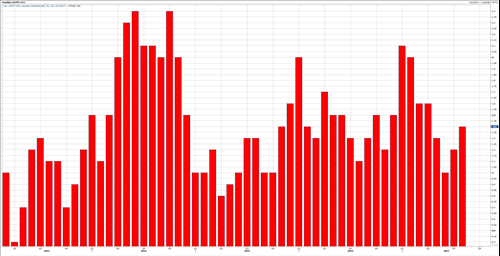

At the same time, traders should keep an eye on the YoY figures. The YoY CPI is expected to advance toward 1.6% up from 1.4%, which would be the third improvement in a row and the highest reading since April.

Canada’s Retail Sales

The retail sales figures will be released side by side with inflation. Estimates are encouraging for the month of August.

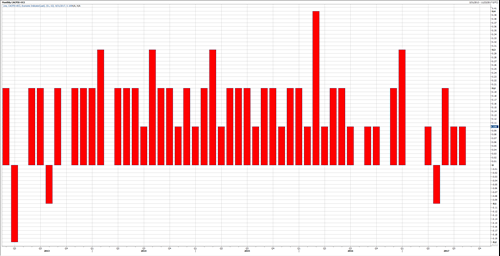

MoM Retail Sales is expected to rise by 0.5% in August compared to 0.4% in July, which would be the sixth monthly increase in a row. One we have not seen since 2014.

The Core Retail Sales is also expected to post 0.3% in August after 0.2% in July, which would be the third monthly increase in a row.

What Matters the Most?

In today’s economic releases, traders should keep an eye on YoY data, especially the inflation figures, as the Bank of Canada has been warning about a faster inflation in the future, which forced the bank to raise rates twice this year.

If inflation comes in with further acceleration, this would keep the possibility for another rate hike by the Bank of Canada later next week.

USDCAD At Resistance Area

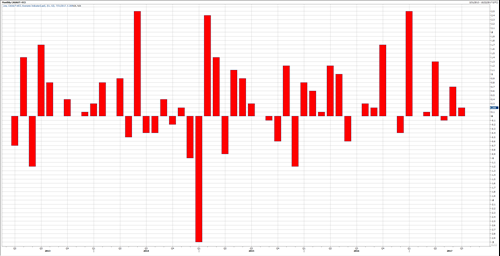

The USDCAD has been retracing to the upside since Mid-September of this year, after the notable decline that started in May of this year from 1.38, all the way down to 1.2060’s, trading around 1.2480’s since the beginning of October.

For the time being, the pair has retraced by more than 61.8% from the latest decline as shown on the chart, and its nearing 0.78% Fibo, which stands around 1.2620’s.

Yet, the pair is still trading below that solid ratio, which should be watched very carefully. As shown on the chart, the pair tried to break above 1.26 twice since the beginning of October without any chance, which support the idea of another leg lower ahead.

However, a catalyst is still needed, which might come from today’s inflation data. Higher inflation would increase the market expectations for another rate hike ahead. In return, USDCAD may resume its down trend starting from today.

The bearish outlook is here to stay as long as USDCAD continues to trade below 1.2780’s, while we look for another leg lower, well below 1.24 later next week.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst