The following are the most important data that may have a direct or indirect impact on the readings to be released today:

- The ISM manufacturing index registered a slowdown in March to 59.3 points, but the manufacturing sector continues to grow for the 19th month in a row. The index's employment component continued to grow for the 18th month in a row despite slowing in March. (positive)

- Non-Manufacturing ISM registered a lower than expected reading of 58.8 points in March, but the non-manufacturing sector showing growth for 98 consecutive months, while the employment component of the sector grew for the 49th month in a row. (positive)

- The private sector employment index added 241,000 jobs in March, the fifth consecutive month, adding jobs higher than 200K and the fourth consecutive month, adding more than 240,000 jobs. (positive)

- The Non-Farm payroll (NFP) usually adds jobs in April each year over the last 8 years, averaging 212K jobs since 2010. (Positive)

- The average of four weeks of weekly unemployment benefits rose to 228 thousand people.

Expected scenarios:

Scenario 1 (Expected)

If the reading of the index came within the range of expectations from 180 to 200 thousand jobs in March, with stable in unemployment rates and improved wages.

- This scenario will support the US Dollar and keep it rising

- EURUSD is expected to see a drop to support level at 1.2190 / 1.22

- Gold prices to decline to the support level at 1316 dollars.

- USDJPY may be heading directly to 108 levels and approaching the 109 levels.

Scenario 2

The index added a better reading than the current forecast of 240,000 jobs or more, as well as improving in wages and stabilizing in unemployment rates at current levels

- This will support the USD strongly and push it higher against its rivals

- EURUSD is expected to exceed support levels at 1.2190 and may be heading towards the next support level at 1.2090.

- Gold will drop strongly, and we may see it at support levels of $ 1306. The USDJPY could rise to 110/111 levels.

Scenario 3

It is the most pessimistic scenario that March readings will come below expectations or below 100K levels

- That would be a more negative scenario for the US dollar and would push it down significantly against its rivals

- EURUSD may rise to reach 1.2280 / 1.23 levels.

- Gold to rise above $ 1330 per ounce.

- The USDJPY may be retreating significantly, returning to 105/10 levels.

Equiti Research Team:

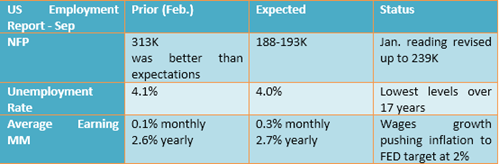

We are more inclined to the first scenario, which suggests that the economy will add jobs within the range of 180 to 200 thousand jobs, that unemployment will stabilize near 17-year lows, and that the wages will rise to 0.3 percent. Those data would keep momentum for the US dollar which t gained during the past few days.

Attention will be paid to wage rates and if it approached 3% levels it will be very positive and will help inflation to rise towards the Fed's target of 2%. Therefore, it will help US dollar strongly, and we could see acceleration in the path of tightening policy. While the continued slowdown in wages will be significantly negative for the dollar.