US Non-Farm Payroll Scenarios 04-02-2022

Today, the financial markets are eyeing the Non-farm payroll report issued from the US Bureau of Labor Statistics in the wake of the Fed’s intention to tighten its monetary policy. The Fed will likely hike its rate for the first time since late 2018, next month when it ends the massive asset purchase program of $120 billion a month.

The US economy is expected to add between 110-150 thousand jobs in January, its weakest pace of job growth since December 2020, affected by the Omicron mutation where it left many US citizens out of jobs. Market participants expect the numbers to be either much lower from the previous reading or worse, where the US economy lost jobs during January. (Morgan Stanley expects the economy to lose about 215,000 jobs in January.)

The US private-sector jobs report showed that the economy lost 301 thousand jobs in January, and although the economy restored about 6 million jobs last year, private sector jobs are still about 4 million jobs less than pre-pandemic levels. The loss of 301,000 jobs in the private sector came as a surprise, and it was the first drop in the ADP report since December 2020.

Several Federal Reserve officials have already made it clear that they will ignore the weak data temporarily as the Fed is not expected to consider any near-term weakness in the labor market. Therefore, the Fed will raise rates in March regardless of the upcoming Reading, and if the labor market weakness continues for the next two months after that, then the Federal bank will start to reconsider its future monetary policy tightening.

If we look at some economic indicators regarding the employment sector in the US economy, we will notice the following:

- The employment component of the ISM manufacturing index registered a slight increase from last month's Reading. (positive)

- As for the employment component of the ISM non-manufacturing index, it decreased by more than two points. (negative)

- The private sector lost 301 thousand jobs in January, and the Reading for December was revised lower. (negative)

- An increase in the 4-week average of unemployment benefits to 255 thousand compared to the previous month, which recorded 205 thousand. (negative)

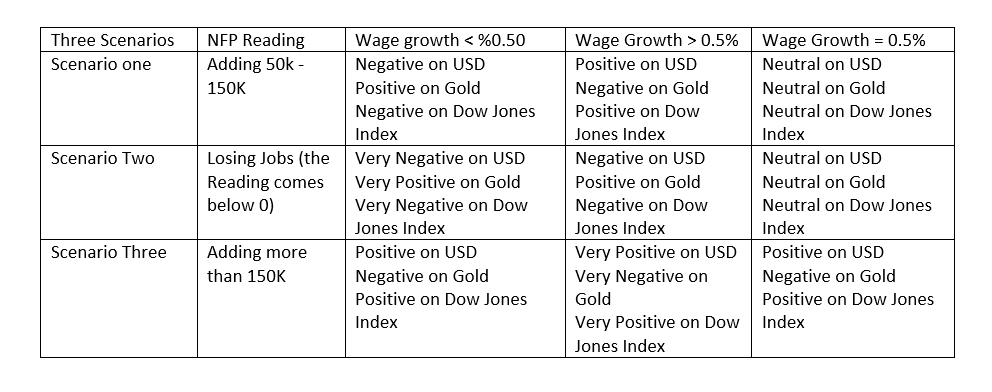

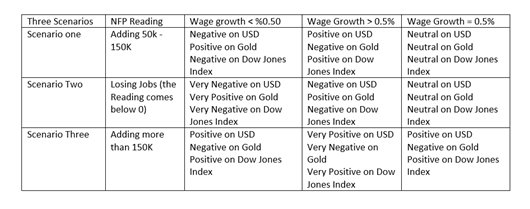

Based on the above points, we highlighted below a review of the upcoming scenarios for the NFP report and its readings impact on the movements of each of (the US dollar, gold, the Dow Jones index):